For families in the worlds of elite sports, the commitment to the sport is a significant investment of time, energy, and resources. Between club fees, travel circuits, elite coaching, and navigating new NIL legislation, the "sports squeeze" is real. At the same time, high-achieving families often face a complex financial landscape where high incomes are met with high tax brackets, making it difficult to balance current sports expenses with long-term legacy goals. Success in these disciplines requires precision and a specialized playbook—your financial strategy should be no different.

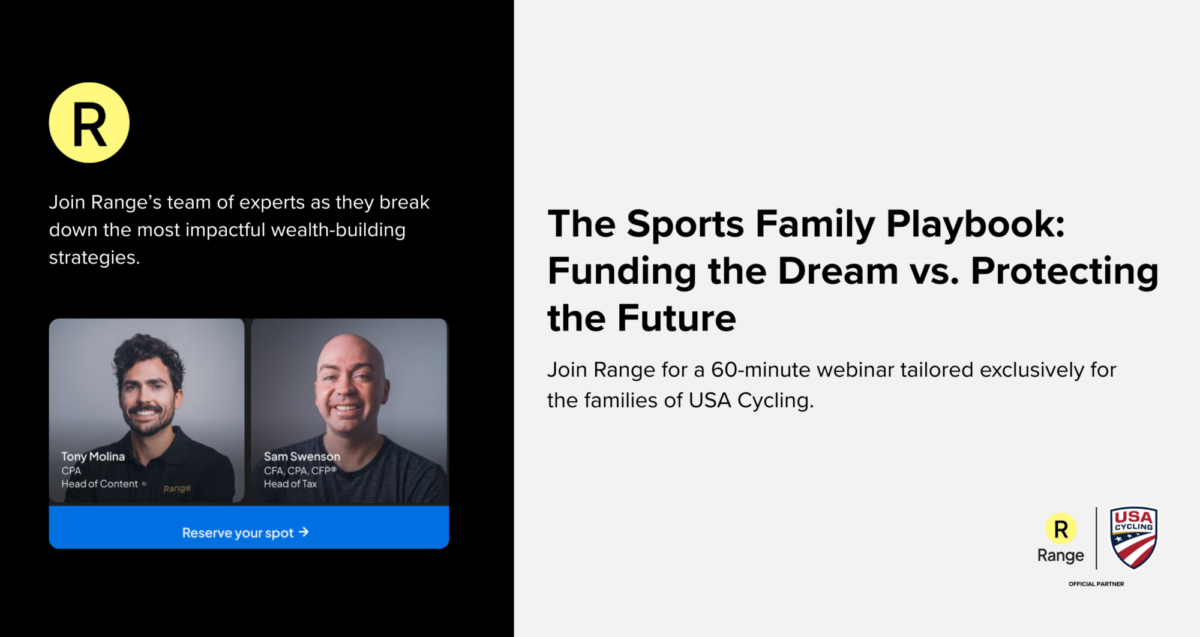

The Sports Family Playbook: Funding the Dream vs. Protecting the Future

Speaker #1: Sam Swenson, CPA/CFP® – Range's Head of Tax

Speaker #2: Tony Molina – Webinar Host & Head of Content

In this session, we’ll dive into essential wealth strategies for high-performing families, including:

- Strategic Cash Flow: Using Tiered Liquidity and SBLOCs for peak performance.

- The NIL Revolution: Navigating the House Settlement and the 2026 HUSTLE Act.

- Minimizing "Tax Drag"

- Advanced Wealth Vehicles: Mastering Backdoor and Mega Backdoor Roths.

- Optimizing Asset Location

- The ROI Reality Check: Scholarship vs. S&P 500

USA Cycling members can learn more about Range and get access to 15% off an annual plan by clicking here.